work in process accounting

Accounting for Work in Progress. Raw materials factory workers and manufacturing overhead added to WIP.

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Items are held in the.

. WIP inventory includes the cost of raw. This may be monthly quarterly or yearly. These items are typically located in the production area though they.

Work in Process Accounting. The work-in-process is an Inventory account on the Balance Sheet or rather a component of this asset account. By Dominic Vaiana.

The manufacturing overhead during the period including indirect raw materials and indirect labor is determined to be 10000. The ending WIP count. FIFO method assumes that those units which represent work-in-progress at the beginning are completed first and the.

These goods are situated between raw materials and finished goods in the production process flow. The financial accounting of everything that is happening in. Each team member is to be.

Raw materials being turned into final goods but not yet finished. Work-in-progress at the beginning of the year 35900. The work in process goods are somewhere in between.

Accounting with Opening and Closing Work-in-Progress-FIFO Method. Work in progress on the other hand is usually used to report. Consider the following information about work-in-progress for a company.

The work-in-process inventory account is the asset account that a company uses in order to record the value of its work-in-process. Work in process WIP inventory refers to materials that are waiting to be assembled and sold. Work-in-process inventory is materials that have been partially completed through the production process.

This account includes the accounting. In accounting the term work in process means the goods that are under the process of completion but are not completed yet. Check your cost of goods manufactured with the instructor.

To calculate the WIP precisely you would have to count each inventory item and determine the valuation accordingly manually. Work in process is goods in production that have not yet been completed. Work-in-process is a part of the inventory asset account on the balance sheet.

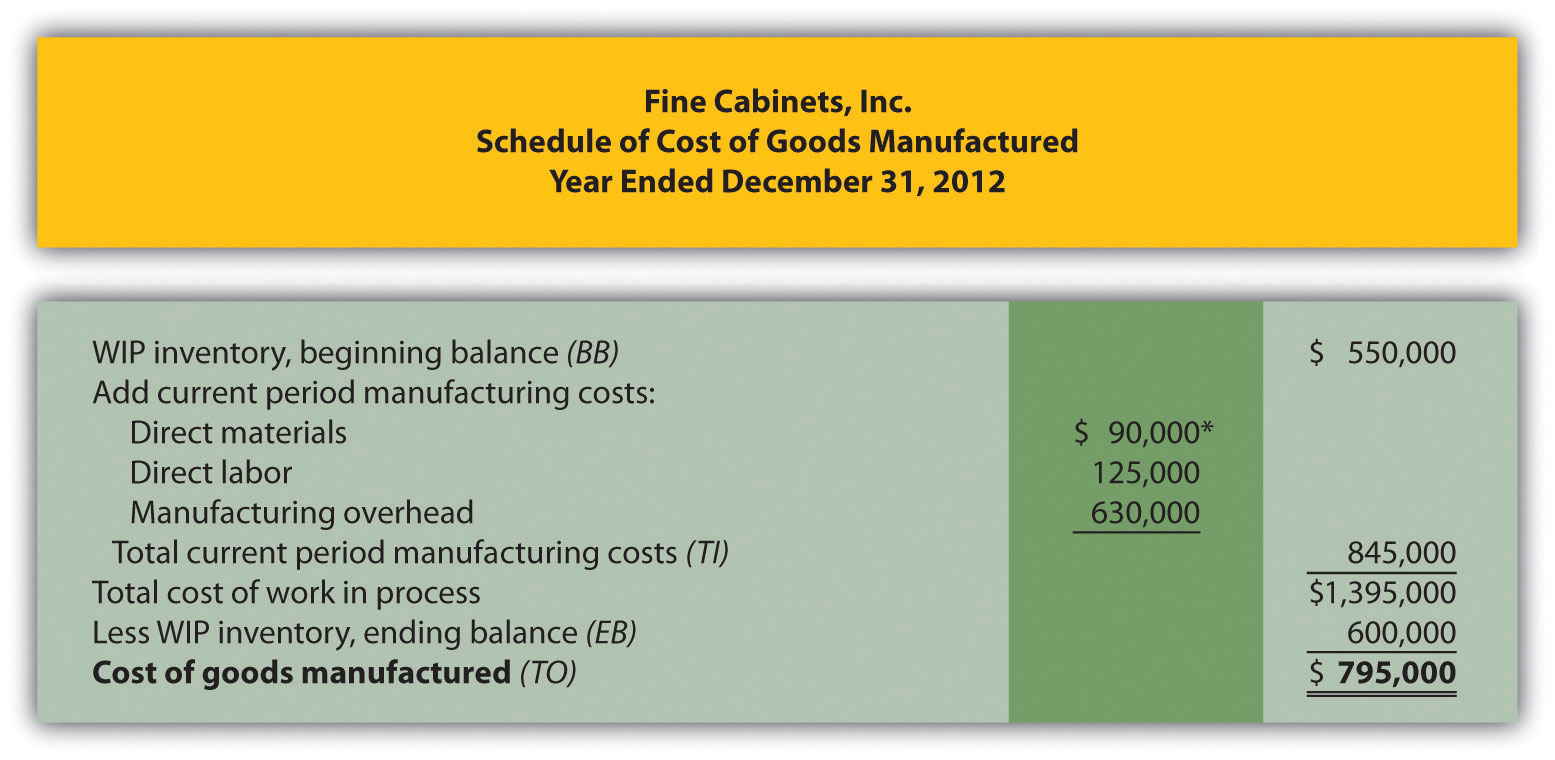

Work in progress is typically measured at the end of an accounting period in order to assign a valuation to the amount of inventory that is on. In this case the company ABC can make the journal entry of. Cost of goods manufactured.

Subsequently work-in-process inventory costs are transferred to the finished goods account. If it is correct proceed to part 3. Work-in-progress at the end.

Work in process is used to report inventory items that are currently being constructed but are not yet done. Fortunately you can use the work-in-process. A work in process though generally takes the same amount of time and follows the same steps in the manufacturing process during each accounting period.

Usually a company takes a WIP count at an established accounting period. If work-in-process inventory is worth 10000 and the final value of those products upon completion is 50000 the additional 40000 in production costs must be accounted for. Total cost of work in process.

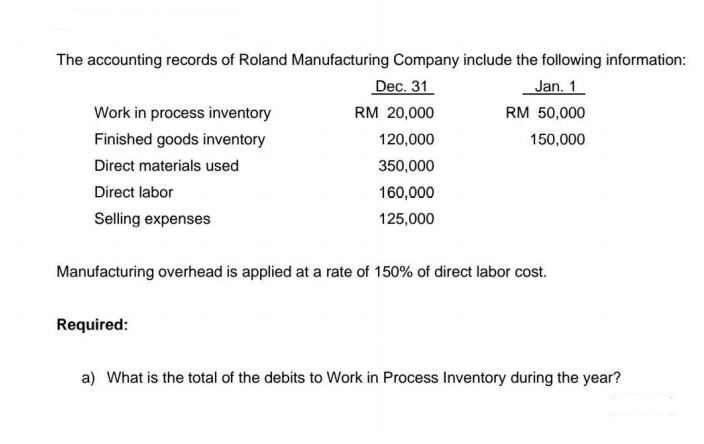

Answered The Accounting Records Of Roland Bartleby

Managerial Accounting By James Jiambalvo Ppt Download

Overview Of Cost Of Goods Manufactured Course Hero

Managerial Accounting Ed 15 Chapter 4a

Work In Progress Wip Definition Example Finance Strategists

Income Statements For Manufacturing Companies

Cost Accounting Dcon Ebooks Com

Report Spotlight The Work In Process Wip Financial Report In Erp Manufacturing Software For Sage Quickbooks Oracle Industrios

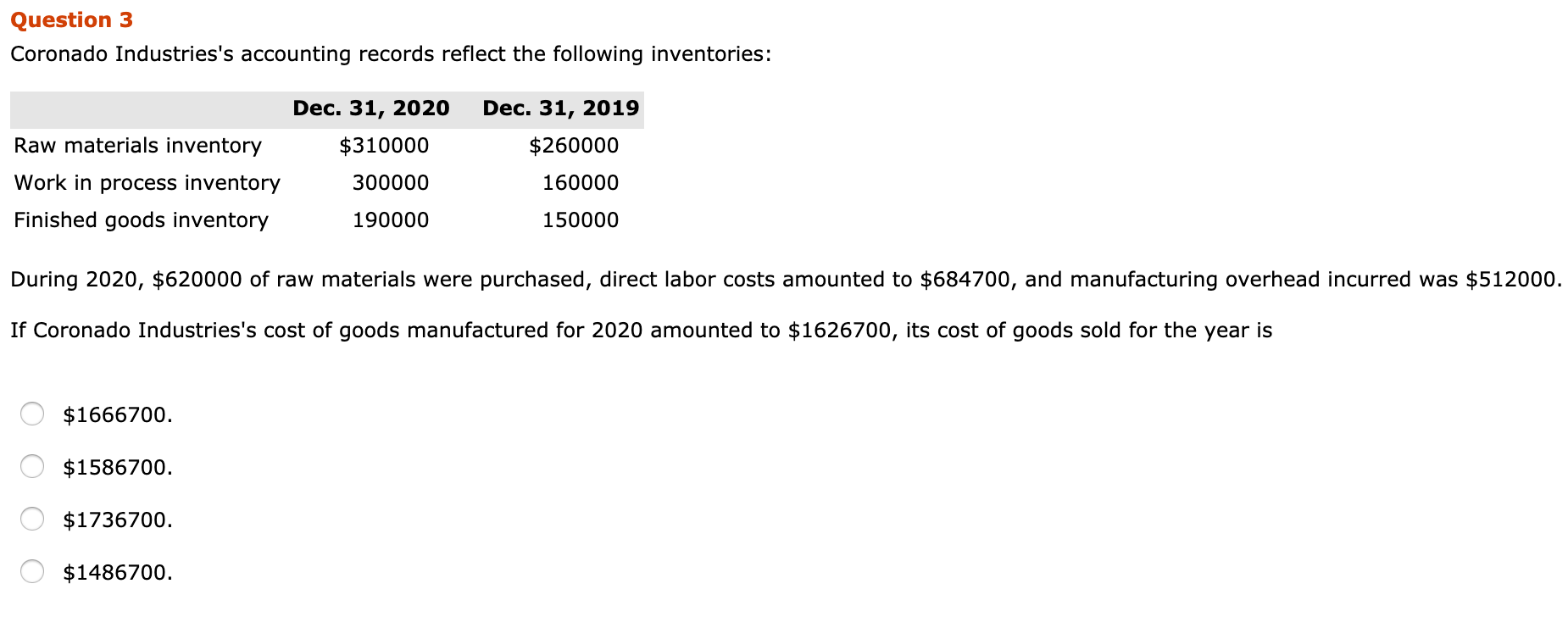

Solved Question 3 Coronado Industries S Accounting Records Chegg Com

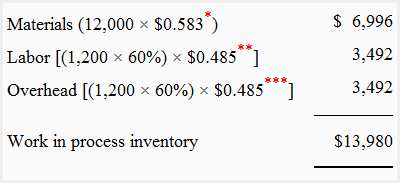

Problem 2 Cost Assigned To Work In Process Inventory Accounting For Management

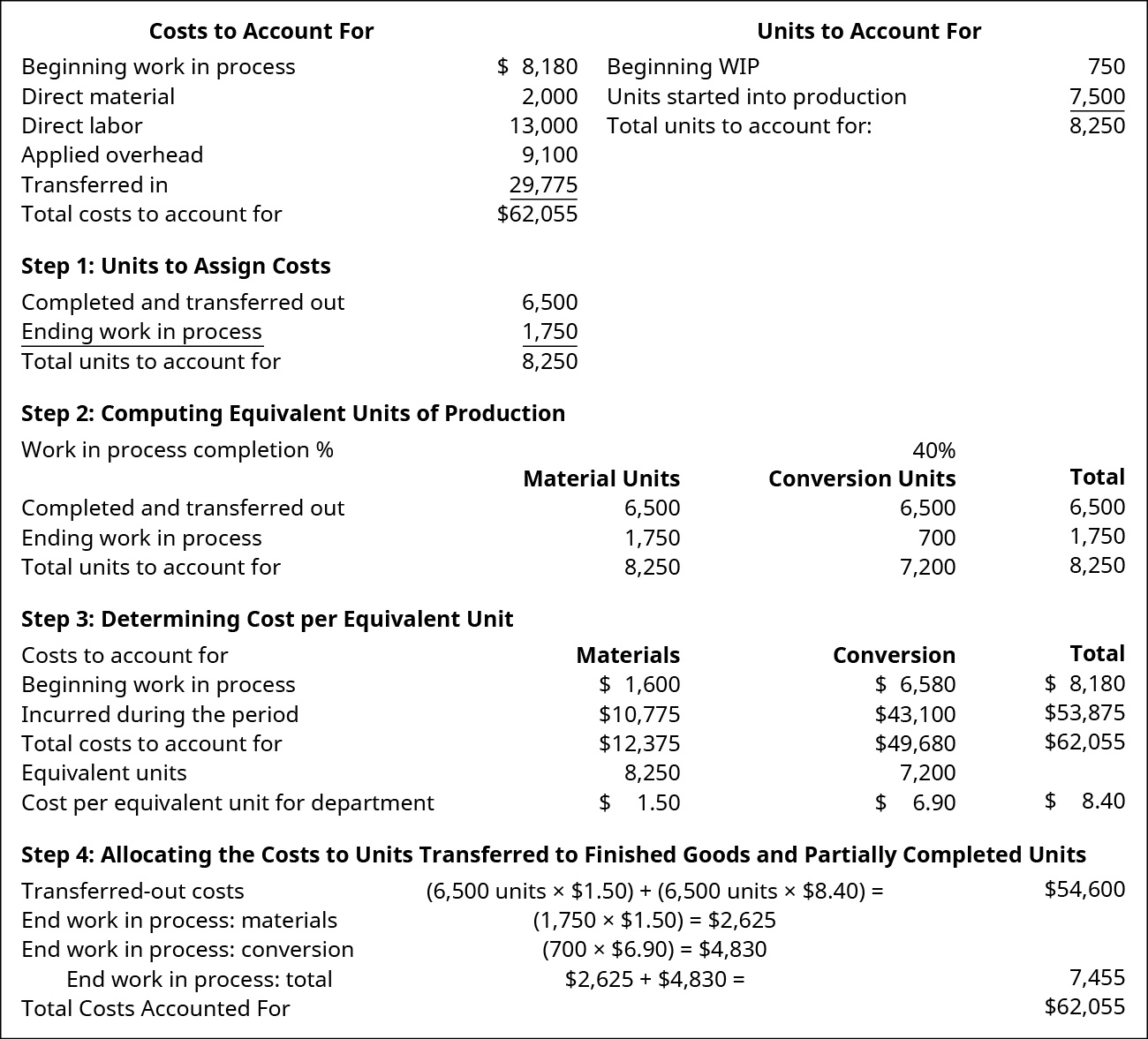

8 13 Journal Entries In Process Costing Financial And Managerial Accounting

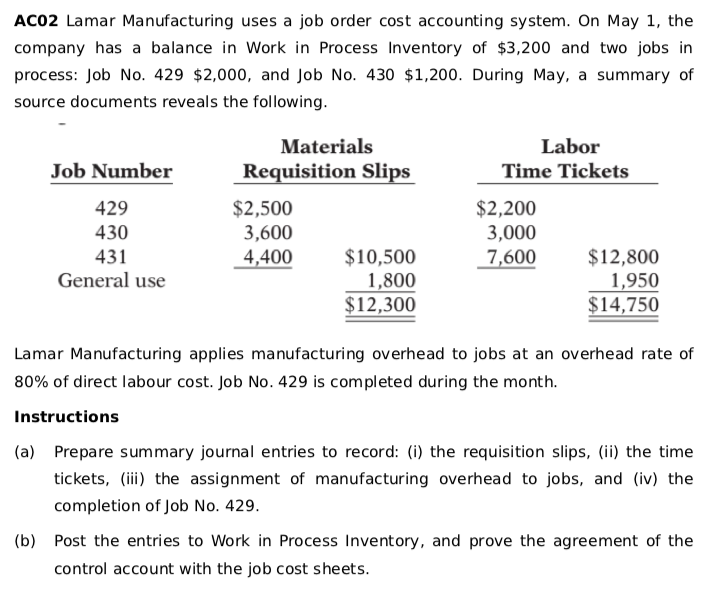

Solved Aco2 Lamar Manufacturing Uses A Job Order Cost Chegg Com

Work In Progress Wip What Is It

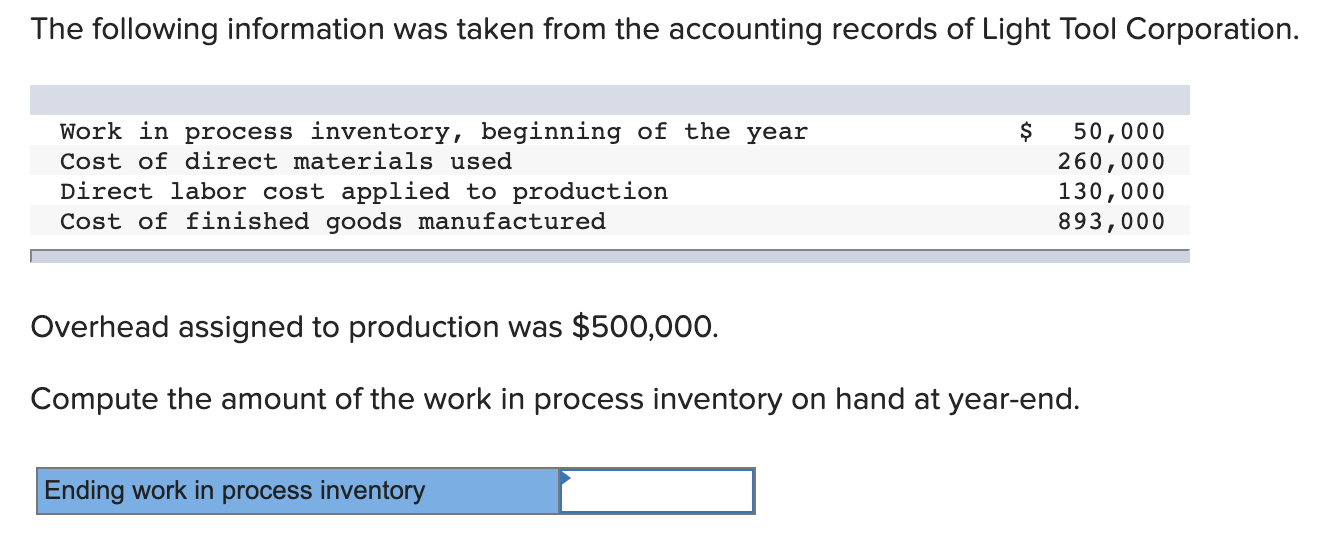

Solved The Following Information Was Taken From The Chegg Com

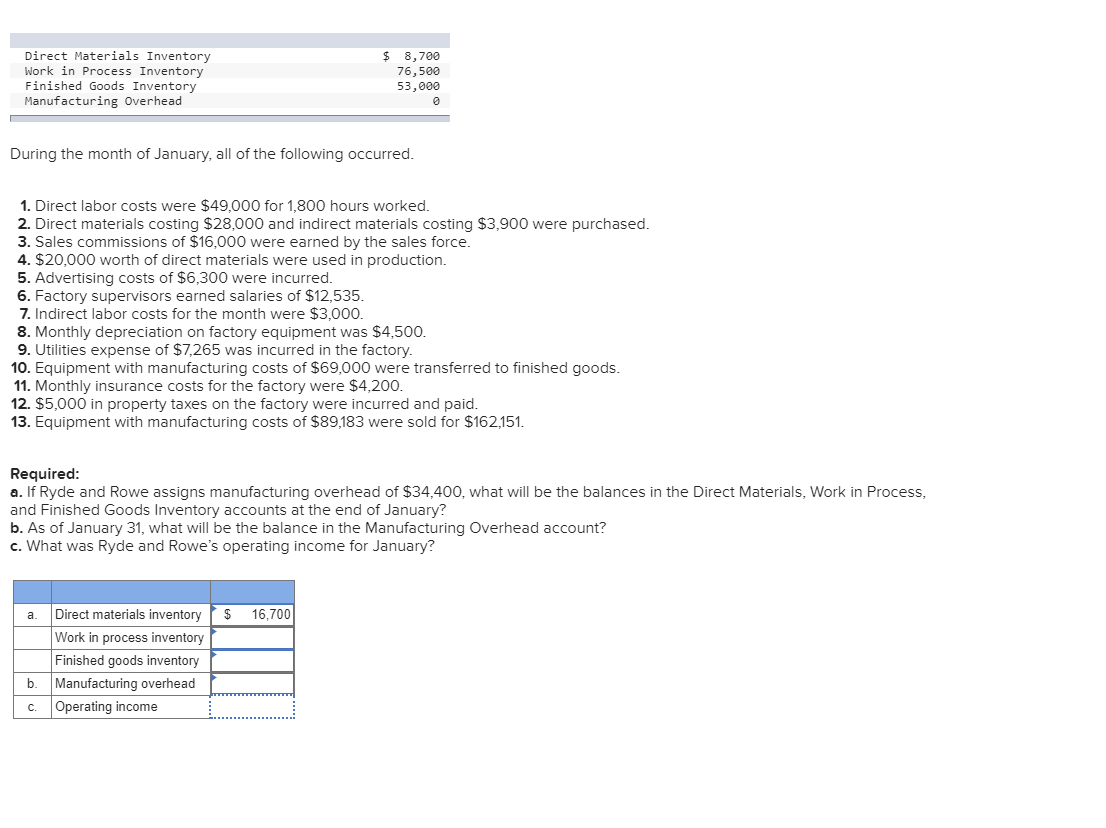

Solved Direct Materials Inventory Work In Process Chegg Com

Describes Job Order Costing Managerial Accounting Accounting Basics Accounting Student

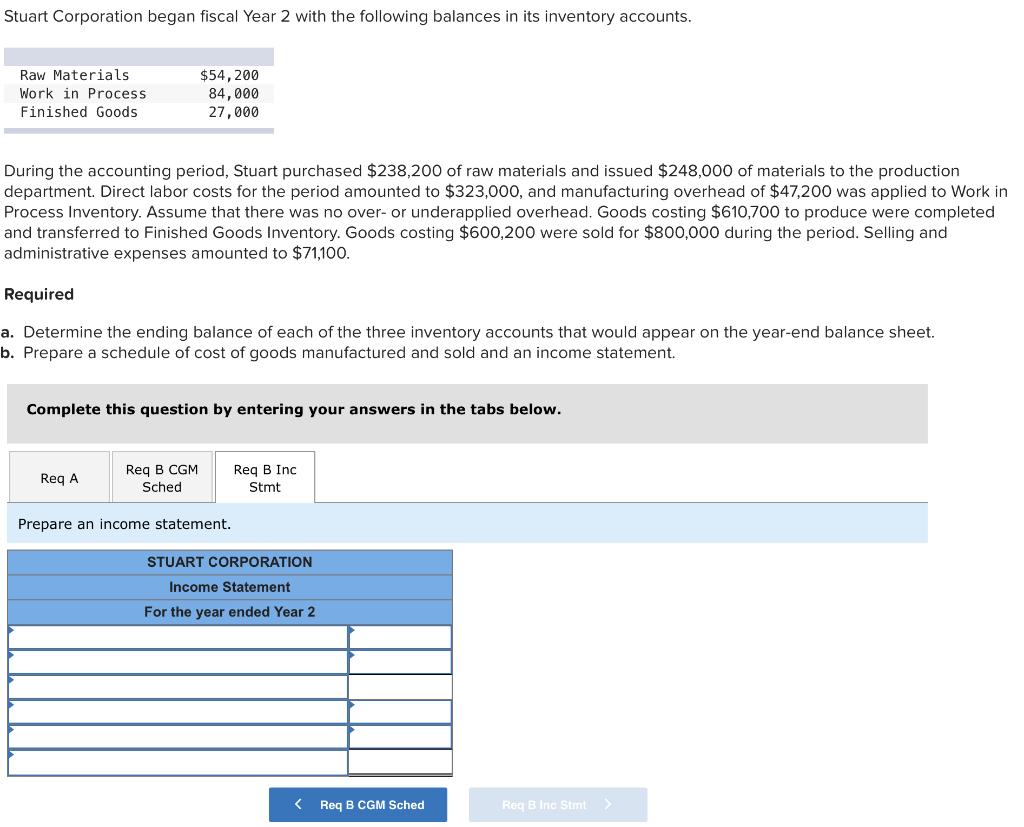

Solved Stuart Corporation Began Fiscal Year 2 With The Chegg Com

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Solved The Following Data From The Just Completed Year Are Taken From The Accounting Records Of Kenton Company Sales 975 000 Direct Labor Cost Course Hero